Recognizing Just How Penny Stocks Work: A Comprehensive Guide

If you're taking into consideration venturing right into the world of penny stocks, it's necessary to realize exactly how they run. You may question what establishes penny stocks apart or how to browse their unpredictable landscape.

What Are Penny Stocks?

Dime stocks are inexpensive shares of tiny business, typically trading for much less than $5 per share. As you navigate the penny stocks market, you'll see that trading quantities can be reduced, leading to cost volatility. While penny stocks can be luring, proceed with care and validate you're conscious of the inherent risks included.

Features of Penny Stocks

Cent supplies normally have a low market capitalization, which means their overall value is smaller sized contrasted to larger business. This characteristic usually brings about high volatility risks, making these stocks extra unpredictable. Understanding these characteristics can help you browse the possible rewards and challenges of buying penny stocks.

Reduced Market Capitalization

One specifying characteristic of penny stocks is their reduced market capitalization, generally valued under $300 million. This function makes them easily accessible to individual capitalists, enabling you to acquire shares at a reduced cost. However, investing in stocks with reduced market cap can likewise show a lack of stability and liquidity. These business frequently operate in particular niche markets or are in the very early stages of development, which can indicate high potential for fast change. As a result of their little size, also small changes in efficiency or market sentiment can substantially affect their supply price. As you take into consideration investing in penny stocks, it's important to examine the hidden company and its possibility for development, ensuring you make educated decisions.

High Volatility Risks

Spending in stocks with reduced market capitalization commonly leads to direct exposure to high volatility risks. Since penny stocks typically have fewer buyers and vendors, their costs can swing significantly within brief periods. Being aware of these threats can assist you make informed choices and potentially shield your financial investments in the penny stocks market. penny stocks.

How Penny Stocks Costs Are Influenced

While several aspects can influence supply costs, penny stocks typically react extra considerably to market conditions and investor sentiment than bigger stocks. You'll locate that news occasions, revenues reports, and sector advancements can cause sharp cost movements. When favorable news hits, exhilaration can drive demand, pressing prices up promptly. On the other hand, adverse press can cause worry offering, creating costs to plummet.

In addition, liquidity plays a crucial duty in penny stocks pricing. Because these supplies have a tendency to have lower trading quantities, even little buy or sell orders can bring about considerable cost changes. The influence of social networks and on-line forums can't be disregarded either; fads and conversations can create hype, attracting short-term investors and influencing rates considerably.

Lastly, market sentiment, whether optimistic or pessimistic, can guide your trading decisions and ultimately affect stock costs. Remain educated and be mindful of these variables as you browse the penny stocks landscape.

Risks Associated With Purchasing Penny Stocks

Although penny stocks can provide attracting chances for quick revenues, they include considerable risks that can catch also skilled capitalists unsuspecting. Their reduced liquidity commonly makes it hard to get or offer shares without affecting the price visibly. This implies you might be stuck with a supply that's tough to offer when you need to.

Furthermore, penny stocks are often subject to high volatility. Rate swings can be extreme, which can bring about considerable losses quickly. These companies usually lack openness and trustworthy financial information, making it hard to evaluate their real value.

Approaches for Trading Penny Stocks

When it comes to trading penny stocks, having a solid method is vital for steering the integral threats and making best use of possible have a peek here benefits. Next off, research thoroughly-- look into the firm's principles, administration group, and recent news.

Concentrate on volume and liquidity; choose stocks that are proactively traded to guarantee you can go into and leave settings conveniently. Use technological evaluation to identify patterns and possible entrance and departure factors.

Don't forget to diversify your portfolio to spread out risk throughout numerous supplies. By adhering to these strategies, you'll be much better equipped to navigate the volatile world of penny stocks while enhancing your possibilities for success.

Usual Myths About Penny Stocks

When it concerns penny stocks, you might hear that they're all high risk with high benefits or that they're constantly a rip-off. These ideas can shadow your judgment and stop you from seeing the full image. Let's clean link up these common myths and help you make educated decisions.

High Danger, High Award

Several investors think that penny stocks inherently supply a high danger and high benefit circumstance, however this idea typically oversimplifies the complexities of these financial investments. It's vital to understand that not all penny stocks are produced equivalent. Diversifying your profile and establishing clear financial investment objectives can assist minimize potential drawbacks, permitting you to navigate the penny stocks landscape extra efficiently.

Constantly a Scam

While it's very easy to classify all penny stocks as rip-offs, doing so forgets the subtleties inherent in this investment category. Yes, some penny stocks are involved in fraudulent systems, yet numerous reputable firms trade at reduced costs due to their size or market position. Rather, technique penny stocks with caution, and remember that due persistance is crucial to separating the scams from the possible success stories.

Just How to Research Penny Stocks Effectively

Investors typically discover that researching penny stocks needs a different strategy compared to more well-known firms. Start by excavating right into the firm's fundamentals, including its economic declarations and business version. Search for revenue development, earnings margins, and any debts that can posture risks.

Next, look for recent information and press launches. This can offer you understanding into the company's advancements and potential catalysts for stock activity. Do not fail to remember to check out on-line discussion forums and social media sites for real-time discussions and opinions from various check website other investors, however be mindful of hype.

Additionally, take into consideration using testing devices to filter stocks based upon criteria like market cap, volume, and price. This assists you find supplies that meet your investment strategy.

Regularly Asked Concerns

Are Penny Stocks Controlled In A Different Way Than Larger Stocks?

Yes, penny stocks are controlled differently than bigger supplies. They often trade on OTC markets, which have much less stringent demands. This can bring about higher dangers, so you should look into extensively before spending in them.

Can I Lose All My Financial Investment in Penny Stocks?

Yes, you can shed all your investment in penny stocks. Their volatility and absence of guideline boost threats. It's necessary to research study extensively and only spend what you can afford to lose. Keep cautious!

What Operating systems Are Finest for Trading Penny Stocks?

To trade penny stocks effectively, you need to take into consideration systems like copyright, E * PROFESSION, and TD Ameritrade. They provide straightforward interfaces, reduced charges, and accessibility to study tools that can aid you make educated decisions.

Exactly how Long Should I Hold Penny Stocks?

You must think about holding penny stocks for a minimum of a couple of months to analyze their potential. Nonetheless, always keep an eye on market fads and business performance, readjusting your technique as needed based upon your financial investment goals (penny stocks).

Do Penny Stocks Pay Dividends?

Dime supplies commonly do not pay returns, as many companies reinvest incomes to grow. If you're trying to find earnings via returns, you may intend to contemplate more established stocks instead.

Bradley Pierce Then & Now!

Bradley Pierce Then & Now! Daniel Stern Then & Now!

Daniel Stern Then & Now! Michael Bower Then & Now!

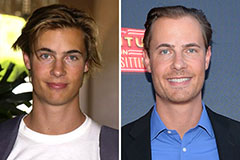

Michael Bower Then & Now! Erik von Detten Then & Now!

Erik von Detten Then & Now! Naomi Grossman Then & Now!

Naomi Grossman Then & Now!